Plan your journey

Manage your risks

Reach your goals

About

Providing Enterprise Risk Management (ERM), Own Risk Solvency Assessments (ORSA), Capital Stress Testing (CST) and Governance, Risk and Compliance (GRC) solutions.

“World class governance, risk and compliance solutions”

Providing Governance, Risk and Compliance (GRC) Frameworks

Regulators, credit rating agencies, shareholders and D&O insurers require evidence of sound governance.

We have a long history of producing robust governance policies and procedures for insurance and finance businesses in many territories with different and changing regulatory requirements.

We can help by reviewing your governance framework against international standards of best practice and the specific requirements of your regulator.

“We can develop and upgrade your governance framework to meet your objectives”

We help produce new business plans, strategies and marketing plans, corporate governance frameworks or policies and procedures, including:

Loans and savings policies and procedures

Underwriting and claims policies and procedures

Audit, risk and compliance policies and procedures

Regulatory reporting policies and procedures

Investment and liquidity policies and procedures

Customer management policies and procedures

Supplier management policies and procedures

IT and Security policies and procedures

Employee management policies and procedures

Reinsurance policies and procedures

ERM360 SaaS

ERM360 is a cloud-based Software-as-a-Service with three modules.

ERM

Manage enterprise risks within a risk appetite framework.

CST

Forecast the impact of scenarios and stress events on the P&L, balance sheet and cashflow.

SIP

Governance, risk and compliance record management and disclosure.

Key Features

Secure

Efficient

Cost-effective

Integrated

Accessible

Reputable

ERM Module

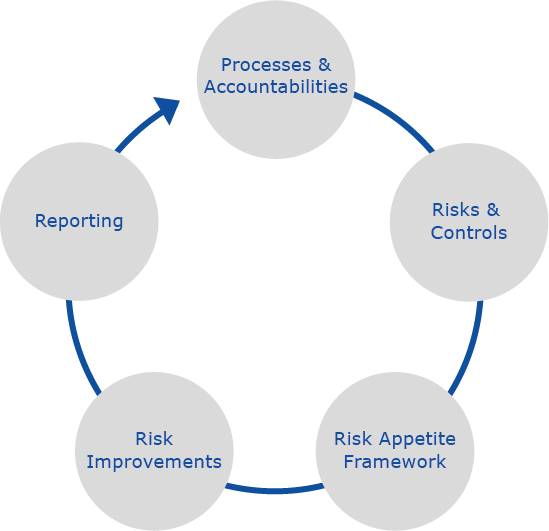

The ERM Module is designed to set up your ERM process, risk appetite framework and risk register to comply with ISO 31000 and regulatory requirements. It enables you to run quarterly risk register reports and track risk improvement actions.

“Demonstrate ERM and obtain an excellent credit rating”

ERM Process

Shock Events

CST Module

The CST Module is designed to create a baseline forecast of expected performance for (say) four years with no shock events occurring; then the baseline is used to analyse the effect of scenario shock events, such as storm and flood.

“Comply with the requirements of regulators and rating agencies”

SIP Module

The SIP Module is designed to keep all your governance policies, guidelines and disclosure records organised, up to date and accessible to authorised groups. It will hold company records and manage record sharing securely. It has the functionality to track, audit and report on file and user activity.

“Never again be unclear on which version of a file was approved or circulated”

Professional support

Our experienced and friendly team of consultants can support and advise on Governance Risk & Compliance (GRC) frameworks, Enterprise Risk Management (ERM), Own Risk Solvency Assessments (ORSA) and Capital Stress Testing (CST).

“We tailor solutions to meet objectives and priorities‘‘

“Equipping executives with know-how and tools to build resilient businesses”

Training

We offer online workshops and can customise training to meet your needs, including:

Setting up the risk appetite framework

Identifying and prioritising enterprise risks

Capital Stress Testing (CST)

Own Risk Solvency Assessments (ORSA)

Establishing sound governance around investment, risk and audit activities

Regulatory compliance

Credit rating applications

Service Plans

Following a consultation with one of our team of professionals, we will develop a bespoke solution documented into a Service Plan to meet your requirements. Fees are based on the size and complexity of the services required.

“Onboarding, support and training is provided as part of the solution”

“ERM360 has enabled us to establish a risk appetite framework and attain an excellent credit rating”

- Finance Director

“ERM360 has fulfilled our ORSA requirements and allowed us to free up capital while meeting regulatory demands”

- CEO

Who we serve

ERM360 solutions are designed to support insurance and finance businesses with:

Governance, Risk and Compliance (GRC)

Enterprise Risk Management (ERM)

Own Risk Solvency Assessments (ORSA)

Capital Stress Testing (CST)

“Comply with regulatory obligations and secure and maintain an excellent credit rating”

Contact us

Please get in touch with us and book a consultation. We look forward to meeting you.

Charles van Oppen, Sales Director and Senior Consultant, ERM360

Office address

ERM 360

41 Trinity Square

London, EC3N 4DJ